首次公开募股/反向收购 IPO / RTO

餐饮 Food & Beverage

食品创新控股有限公司 – 在新加坡交易所凯利板上市 Food Innovators Holdings Limited – IPO on SGX Catalist

了解更多 Learn More

医疗健康 Healthcare

新加坡高级医学研究院控股有限公司 – 在新加坡交易所凯利板上市 Singapore Institute of Advanced Medical Holdings Ltd. – IPO on SGX Catalist

了解更多 Learn More

酒店业 Hospitality

3C能源有限公司 – 反向收购并更名为 ProsperCap 上市 3Cnergy Limited – Reverse Takeover and Listing as ProsperCap

了解更多 Learn More

游戏 Gaming

Winking Studios有限公司 – 首次公开募股和配售 Winking Studios Limited – IPO and Placement Exercise

了解更多 Learn More

制药 Pharmaceutical

Pasture Holdings有限公司 – 在新加坡交易所凯利板上市 Pasture Holdings Ltd. – IPO on SGX Catalist

了解更多 Learn More

二次上市 Secondary Listings

农业 Agriculture

TSH资源有限公司 – 在新加坡交易所主板二次上市 TSH Resources Berhad – Secondary Listing on SGX-ST

了解更多 Learn More

汽车 Automotive

蔚来汽车有限公司 – 在新加坡交易所主板二次上市 NIO Inc. – Secondary Listing on SGX-ST

了解更多 Learn More

数字解决方案 Digital Solutions

AMTD国际有限公司 – 在新加坡交易所主板二次上市 AMTD International Inc. – Secondary Listing on SGX-ST

了解更多 Learn More

并购交易 Mergers & Acquisitions

医疗健康 Healthcare

担任Medeze Treasury对Cordlife集团有限公司现金部分要约的财务顾问 Financial Adviser to Medeze Treasury’s cash partial offer for Cordlife Group Limited

了解更多 Learn More

信息技术 Information Technology

担任Digilife科技有限公司出售全部股权的财务顾问 Financial Adviser for Digilife Technologies Limited’s Disposal of Entire Shareholding Interest

了解更多 Learn More

海洋与能源 Marine and Energy

担任AMOS集团收购案的财务顾问 Financial Adviser for AMOS Group Acquisition

了解更多 Learn More

矿业 Mining

担任Horowitz Capital收购Silkroad Nickel有限公司的财务顾问 Financial Adviser to Horowitz Capital’s to acquire Silkroad Nickel Ltd.

了解更多 Learn More

信息技术 Information Technology

担任SMI Vantage有限公司收购与多元化的财务顾问 Financial Adviser SMI Vantage Limited’s Acquisition and Diversification

了解更多 Learn More

公允性意见 Fairness Opinions

房地产 Real Estate

担任Paragon房地产投资信托通过信托安排私有化的独立财务顾问 IFA for Privatisation of Paragon REIT by way of a trust scheme of arrangement

了解更多 Learn More

制造业 Manufacturing

担任强制性有条件收购的独立财务顾问 IFA for Mandatory Conditional Take Over

了解更多 Learn More

金融服务 Financial Services

担任自愿无条件要约的独立财务顾问 IFA for Voluntary Unconditional Offer

了解更多 Learn More

医疗健康 Healthcare

担任关联方交易的独立财务顾问 IFA for Interested Person Transactions

了解更多 Learn More

能源 Energy

担任关联方交易的独立财务顾问 IFA for Interested Person Transactions

了解更多 Learn More

食品创新控股在凯利板上市 Food Innovators Holdings debuts on Catalist

餐饮 Food & Beverage

2024年10月 October 2024

食品创新控股有限公司("FIH")在新加坡交易所(SGX)凯利板成功上市,标志着该公司进入新纪元,致力于在亚洲提供卓越的日本及日式欧式美食。FIH以每股0.22新元的价格发行1400万股,获得投资者的热烈追捧。公开发售部分超额认购约6.3倍,而所有配售股份均获得个人和企业投资者的充分认购。 Food Innovators Holdings Limited ("FIH") made a successful debut on the Catalist board of the Singapore Exchange (SGX), marking a new era for the company and its commitment to delivering exceptional Japanese and Japanese-inspired European cuisines across Asia. FIH issued 14 million shares at a price of S$0.22 with strong enthusiasm from investors. The Public Offer Shares were oversubscribed by approximately 6.3 times, while all Placement Shares were subscribed up by both individual and corporate investors.

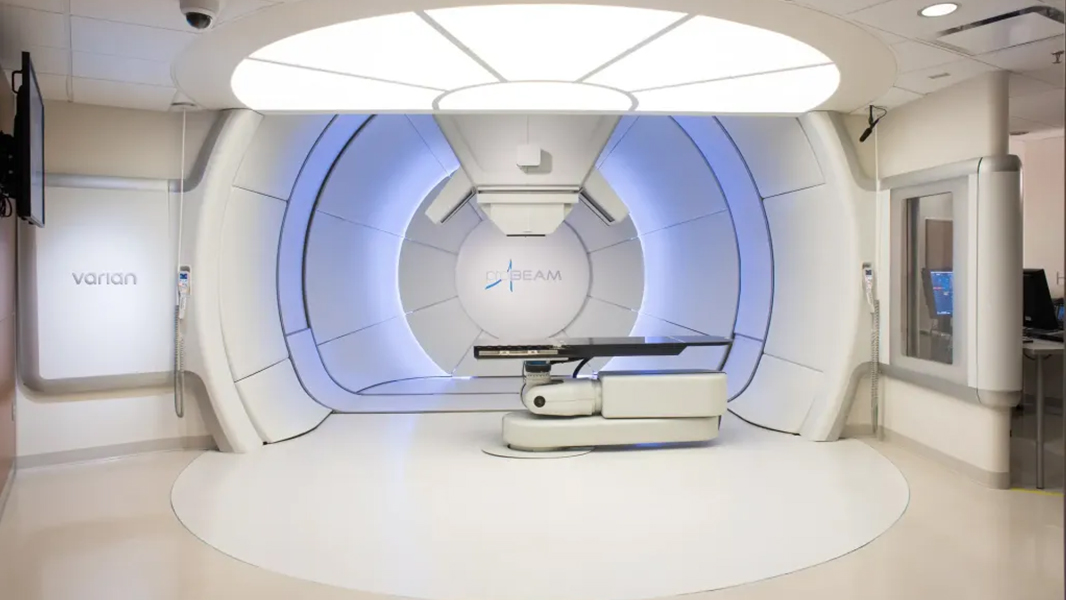

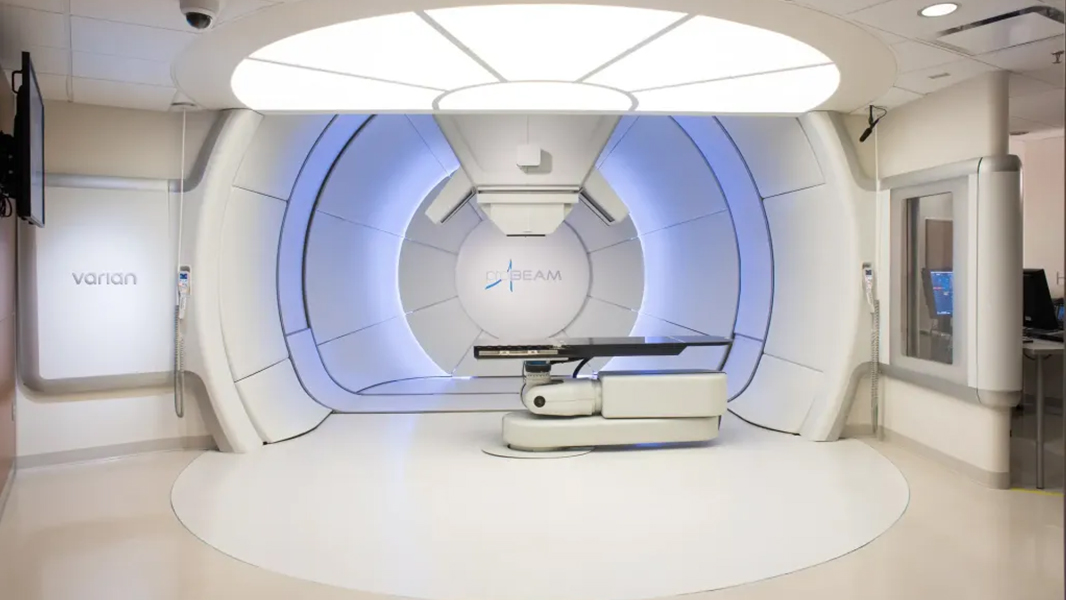

新加坡高级医学研究院控股成功在凯利板上市 Singapore Institute of Advanced Medical Holdings successfully listed on Catalist

医疗健康 Healthcare

2024年2月 February 2024

新加坡高级医学研究院控股有限公司("SIAMH")是一家专注于先进诊断和治疗技术的医疗服务提供商,于2024年2月在新加坡交易所(SGX)凯利板成功上市。PPCF担任首次公开募股(IPO)的保荐人、承销商和配售代理。 Singapore Institute of Advanced Medicine Holdings Ltd. ("SIAMH"), a healthcare service provider specializing in advanced diagnostic and treatment technologies, successfully listed on the Catalist board of the Singapore Exchange (SGX) in February 2024. PPCF served as the Sponsor, Issue Manager, Underwriter, and Placement Agent for the Initial Public Offering (IPO).

此次IPO通过发行1.14亿股新股,每股0.23新元,筹集了2620万新元的总收益,包括公开发售股份和配售股份。公开发售部分获得了强劲支持,全额认购,反映了投资者对SIAMH建立全面一站式门诊癌症中心使命的信心。筹集的资金将用于购置新设备、升级设施、营运资金和偿还银行借款。 The IPO raised gross proceeds of S$26.2 million through the issuance of 114 million new shares at S$0.23 each, comprising Public Offer Shares and Placement Shares. The public offer segment received strong support which was fully subscribed, reflecting investor confidence in SIAMH's mission to establish a comprehensive one-stop ambulatory cancer center. The capital raise allows SIAMH to utilize for acquiring new equipment, upgrading facilities, working capital, and repaying bank borrowings.

ProsperCap在3Cenergy成功反向收购后于凯利板上市 ProsperCap lists on Catalist following successful RTO of 3Cenergy

酒店业 Hospitality

2024年1月 January 2024

3C能源有限公司于2024年1月完成了由泰国企业集团DTGO Corporation的子公司DTP Inter Holdings Corporation Pte. Ltd.进行的反向收购(RTO)。3C能源更名为Prosper Cap Corporation Limited("ProsperCap"),专注于全球酒店和住宿相关市场的投资。 3Cenergy Limited completed the reverse takeover (RTO) by DTP Inter Holdings Corporation Pte. Ltd., a subsidiary of Thailand-based conglomerate DTGO Corporation in January 2024. 3Cenergy was renamed to Prosper Cap Corporation Limited ("ProsperCap"), focusing on investments in the global hospitality and lodging-related market.

ProsperCap拥有17家以高档酒店为主的物业,共3,383间客房,位于英国各主要地区城市。这些物业根据特许经营协议与希尔顿、洲际酒店集团和万豪等知名国际酒店品牌合作运营。 ProsperCap owns 17 predominantly upscale hotels, totalling 3,383 rooms, located in key regional cities across the United Kingdom. These properties operate under franchise agreements with renowned international hotel brands, including Hilton, IHG, and Marriott.

配合反向收购,Prosper Cap以每股0.33新元完成了合规配售,筹集了6930万新元的总收益。PPCF担任保荐人和财务顾问,以及合规配售的独家配售代理。 In conjunction with the RTO, Prosper Cap completed a compliance placement to raise gross proceeds of S$69.3 million at S$0.33 per share. PPCF was the Sponsor and Financial Adviser, and sole Placement Agent for the compliance placement.

Winking Studios在凯利板上市并完成配售 Winking Studios marks its debut on Catalist and completed Placement Exercise

游戏 Gaming

2024年11月和7月 November 2024 and July 2024

Winking Studios有限公司是一家知名的游戏美术外包和开发公司,已完成多项战略性融资活动,以推动其增长和扩张计划。 Winking Studios Limited, a prominent game art outsourcing and development company, has completed various strategic capital-raising exercises to fuel its growth and expansion plans.

在新加坡交易所凯利板首次公开募股(IPO) Initial Public Offering (IPO) on SGX Catalist

Winking Studios成功在新加坡交易所(SGX)凯利板上市,市值为5590万新元,发行4000万股新股,每股0.20新元,包括给宏碁公司的基石股份。PPCF担任此次IPO的保荐人、承销商和配售代理。 Winking Studios successfully listed on the Catalist board of the Singapore Exchange (SGX) with a market capitalisation of S$55.9 million issuing 40 million new shares at S$0.20 each, including cornerstone shares to Acer Inc. PPCF acted as the Sponsor, Issue Manager, and Placement Agent for this IPO.

在新加坡的二次融资活动 Secondary Fund Raising Exercise in Singapore

该公司通过2024年7月完成的配售活动进一步加强了其财务状况,以每股0.25新元的价格筹集了约2650万新元的净收益。所得款项用于战略性企业举措、收购和增强运营能力。PPCF是此次活动的独家配售代理。 The Company further strengthen its financial position through a placement exercise raising net proceeds of approximately S$26.5 million at S$0.25 per share which was completed in July 2024. The proceeds were earmarked for strategic corporate initiatives, acquisitions, and enhancements of operational capabilities. PPCF was the sole Placement Agent for this exercise.

Pasture Holdings在凯利板上市 Pasture Holdings marks its debut on Catalist

制药 Pharmaceutical

2023年6月 June 2023

Pasture Holdings Ltd.是一家总部位于新加坡的医药产品和医疗用品公司,于2023年6月9日在新加坡交易所(SGX)凯利板成功上市。该公司以每股0.25新元的价格成功筹集了500万新元的总收益。筹集的资金旨在加强现有业务部门,扩大公司的全球足迹,并探索新的业务合作机会。 Pasture Holdings Ltd., a Singapore-based pharmaceutical products and medical supplies company, successfully listed on the Catalist board of the Singapore Exchange (SGX) on 9 June 2023. The Company successfully raise gross proceeds of S$5 million at S$0.25 per share. The funds raised are intended to strengthen existing business segments, expand the company's global footprint, and explore new business collaboration opportunities.

作为全程保荐人、承销商和配售代理,PPCF指导Pasture Holdings完成了上市和融资过程。 As Full Sponsor, Issue Manager, Underwriter, and Placement Agent, PPCF guided Pasture Holdings through the listing and fund raising process.

TSH资源成功在新加坡交易所主板二次上市 TSH Resources successfully secondary listing on Mainboard of the SGX

农业 Agriculture

2023年9月 September 2023

TSH资源有限公司是一家马来西亚的油棕种植公司,于2023年9月26日通过介绍方式在新加坡交易所有限公司(SGX-ST)主板完成二次上市。该公司主要从事油棕种植以及将新鲜果串加工成粗棕榈油和棕榈仁。这一战略举措旨在扩大和多元化公司的股东基础,提高交易流动性,并提供额外的融资渠道。 TSH Resources Berhad, a Malaysian-based oil palm plantation company, successfully completed a secondary listing on the Main Board of the Singapore Exchange Securities Trading Limited (SGX-ST) by way of introduction on 26 September 2023. The company is principally engaged in oil palm cultivation and the processing of fresh fruit bunches into crude palm oil and palm kernel. This strategic move aimed to expand and diversify the company's shareholder base, improve trading liquidity, and provide additional avenues for fundraising.

PPCF担任TSH的财务顾问,在促进TSH资源成功进入新加坡资本市场方面发挥了重要作用,提高了公司在更广泛投资者群体中的知名度和可及性。 PPCF acted as Financial Adviser to TSH and was instrumental in facilitating TSH Resources' successful entry into the Singapore capital market, enhancing the company's visibility and accessibility to a broader spectrum of investors.

蔚来汽车成功在新加坡交易所主板、香港交易所和纽约证券交易所双重上市 NIO successfully dual-lists on Mainboard of the SGX, HKEX and NYSE

汽车 Automotive

2022年5月 May 2022

蔚来汽车有限公司是一家总部位于中国的领先高端智能电动汽车制造商,于2022年5月通过介绍方式在新加坡交易所有限公司(SGX-ST)主板完成二次上市。蔚来在纽约证券交易所(NYSE)有主要上市,在香港联合交易所(HKEX)有二次上市,此次在新加坡交易所的二次上市标志着蔚来在扩大股东基础和增强全球市场地位方面的又一重要里程碑。 NIO Inc., a leading premium smart electric vehicle manufacturer headquartered in China, completed its secondary listing by way of introduction on the Main Board of the Singapore Exchange Securities Trading Limited (SGX-ST) in May 2022. With primary listing on the New York Stock Exchange (NYSE) and a secondary listing on the Hong Kong Stock Exchange (HKEX), the secondary listing on SGX marked another significant milestone in NIO's journey toward broadening its investor base and enhancing its global market presence.

蔚来将新加坡视为其长期增长的战略枢纽,利用这个城市国家强大的资本市场和投资者对创新产业的浓厚兴趣。二次上市强调了蔚来致力于建立全球影响力,同时为其股东提供多元化的交易场所。 NIO viewed Singapore as a strategic hub for its long-term growth, leveraging the city-state's robust capital markets and strong investor interest in innovative industries. The secondary listing underscores NIO's commitment to fostering a global presence while offering diversified trading venues for its shareholders.

AMTD国际成功在新加坡交易所主板和纽约证券交易所双重上市 AMTD International successfully dual-lists on Mainboard of the SGX and NYSE

数字解决方案 Digital Solutions

2020年4月 April 2020

AMTD国际有限公司(现称为AMTD Idea Group)是一站式商业服务和数字解决方案平台AMTD集团的子公司,于2020年4月8日通过介绍方式在新加坡交易所有限公司(SGX-ST)主板完成二次上市。此次上市标志着AMTD国际成为首家在纽约证券交易所和新加坡交易所双重上市的公司,也是首家在新加坡上市的具有双重股权结构的公司。这一战略举措旨在提高AMTD国际在亚太地区投资者中的知名度和可及性,利用新加坡充满活力的资本市场与全球投资者建立联系。 AMTD International Inc. (now known as AMTD Idea Group), a subsidiary of AMTD Group, a one-stop business services and digital solutions platform, successfully completed a secondary listing by way of introduction on the Mainboard of the Singapore Exchange Securities Trading Limited (SGX-ST) on 8 April 2020. This listing marked AMTD International as the first company to be dual-listed on both the NYSE and SGX-ST, and the first with a dual-class share structure to list in Singapore. This strategic move aimed to enhance AMTD International's visibility and accessibility to investors in the Asia-Pacific region, leveraging Singapore's dynamic capital market to connect with global investors

PPCF被任命为财务顾问,监督二次上市程序并确保符合新加坡交易所的规定。 PPCF was appointed as the Financial Adviser to oversee the secondary listing procedure and ensuring compliance with SGX regulations.

Medeze发起对Cordlife集团有限公司的自愿有条件现金部分要约 Medeze launched voluntary conditional cash partial offer for Cordlife Group Limited

医疗健康 Healthcare

2025年5月 May 2025

PPCF担任Medeze Treasury Pte. Ltd.的财务顾问。Medeze Treasury是在泰国证券交易所上市的Medeze集团PCL的全资子公司,于2025年5月宣布以每股0.25新元的价格自愿有条件现金部分要约收购Cordlife集团有限公司10%的已发行普通股。要约价格较Cordlife的现行市价有显著溢价,旨在为股东提供以有吸引力的估值实现部分投资的机会。 PPCF was the Financial Adviser to Medeze Treasury Pte. Ltd.. Medeze Treasury, a wholly-owned subsidiary of Medeze Group PCL which is listed on the Stock Exchange of Thailand, announced a voluntary conditional cash partial offer in May 2025 to acquire 10% of the issued ordinary shares of Cordlife Group Limited at S$0.25 per share. The offer price represented a significant premium to Cordlife's prevailing market price and aimed to provide shareholders with an opportunity to realise part of their investment at an attractive valuation.

Digilife出售其在Modi Indonesia 2020 Pte. Ltd.的全部股权 Digilife's Disposal of the Entire Shareholding Interest in Modi Indonesia 2020 Pte. Ltd.

电信与科技 Telecommunications and Technology

2024年2月 February 2024

PPCF担任Digilife科技有限公司("Digilife")向NFT Digital Pte. Ltd.("NFT Digital")出售其在Modi Indonesia 2020 Pte. Ltd.("Modi Indonesia")全部股权的财务顾问。此项交易价值992万新元,分两期进行,第一期(60%的股份)于2025年2月18日完成,第二期(40%的股份)计划在六个月内完成。这一战略性剥离符合Digilife精简运营和提高股东价值的重点。 PPCF was the Financial Adviser to Digilife Technologies Limited ("Digilife") in its disposal of the entire shareholding interest in Modi Indonesia 2020 Pte. Ltd. ("Modi Indonesia") to NFT Digital Pte. Ltd. ("NFT Digital"). The transaction, valued at S$9.92 million, was structured in two tranches, with Tranche 1 (60% of shares) completed on 18 February 2025 and Tranche 2 (40% of shares) scheduled for completion within six months. This strategic divestment aligns with Digilife's focus on streamlining operations and enhancing shareholder value.

PeakBayou收购AMOS集团 PeakBayou's Acquisition of AMOS Group

海洋与能源 Marine and Energy

2024年12月 December 2024

PeakBayou收购AMOS集团 PeakBayou's Acquisition of AMOS Group

PPCF担任PeakBayou Ltd.("PeakBayou")的财务顾问,该公司于2024年9月25日发起自愿无条件全面要约,收购在新加坡交易所(SGX-ST)主板上市的AMOS集团有限公司("AMOS")的所有已发行普通股。要约于2024年12月12日截止,PeakBayou成功收购了AMOS的绝大多数股份。 PPCF was the Financial Adviser to PeakBayou Ltd. ("PeakBayou") who launched a voluntary unconditional general offer to acquire all issued ordinary shares of AMOS Group Limited ("AMOS"), a company listed on the Mainboard of the Singapore Exchange (SGX-ST) on 25 September 2024. The offer closed on 12 December 2024, with PeakBayou successfully acquiring a significant majority of AMOS's shares.

担任Horowitz Capital Ltd.自愿无条件要约的财务顾问 FA to Horowitz Capital Ltd. for Voluntary Unconditional Offer

矿业 Mining

2022年9月 September 2022

PPCF被任命为Horowitz Capital Ltd.("Horowitz Capital")的财务顾问,该公司于2022年8月29日发起自愿有条件全面要约,收购在新加坡交易所(SGX-ST)凯利板上市的Silkroad Nickel Ltd.("Silkroad Nickel")的所有已发行普通股。 PPCF was appointed as the Financial Adviser to Horowitz Capital Ltd. ("Horowitz Capital"), who launched a voluntary conditional general offer on 29 August 2022 to acquire all the issued ordinary shares of Silkroad Nickel Ltd. ("Silkroad Nickel"), a company listed on the Catalist Board of the Singapore Exchange (SGX-ST).

在Horowitz Capital及其一致行动人获得超过Silkroad Nickel已发行股份90%后,要约于2022年9月26日成为无条件,从而能够强制收购剩余股份。 The offer became unconditional on 26 September 2022 after Horowitz Capital and its concert parties secured more than 90% of Silkroad Nickel's shares, thereby enabling the compulsory acquisition of the remaining shares.

担任SMI Vantage有限公司收购与多元化的财务顾问 FA to SMI Vantage Limited's Acquisition and Diversification

信息技术 Information Technology

2022年4月 April 2022

SMI Vantage有限公司("SMI Vantage")于2022年4月获得股东批准后,多元化进入加密货币挖矿业务,其业务范围扩展至包括挖矿机的交易、租赁、挖矿和托管以及软件即服务(SaaS)计划。 SMI Vantage Limited ("SMI Vantage") diversified into the cryptocurrency mining business following shareholder approval in April 2022, expanding its scope to include trading, leasing, mining, and hosting of mining machines alongside software-as-a-service (SaaS) initiatives.

PPCF被任命为SMI Vantage的财务顾问,参与这项多元化和收购战略。 PPCF was appointed as the Financial Adviser to SMI Vantage in connection with this diversification and acquisition strategy.

担任Paragon房地产投资信托私有化的独立财务顾问 IFA for Privatisation of Paragon REIT

房地产投资信托(REIT) Real Estate Investment Trust (REIT)

2025年2月 February 2025

PPCF被任命为独立财务顾问(IFA),就符合新加坡收购与合并守则和Paragon信托契约的信托安排计划提供意见。计划对价为每单位0.98新元,较最后交易价格溢价10.1%,对该房地产投资信托的估值约为27.8亿新元。 PPCF was appointed as the Independent Financial Adviser (IFA) in connection with the trust scheme of arrangement in compliance with the Singapore Code on Take-overs and Mergers and the Paragon Trust Deed. The scheme consideration was S$0.98 per unit, representing a 10.1% premium over the last traded price and valuing the REIT at approximately S$2.78 billion.

此次私有化预计将使Cuscaden Peak能够对Paragon房地产投资信托的旗舰乌节路资产进行长期战略改进,包括高达6亿新元的潜在资本支出,以保持竞争力并释放价值。 The privatisation is expected to allow Cuscaden Peak to undertake long-term strategic enhancements to Paragon REIT's flagship Orchard Road asset, including potential capital expenditure of up to S$600 million to maintain competitiveness and unlock value.

该计划在2025年3月的计划会议和特别股东大会上获得单位持有人批准。Paragon房地产投资信托单位的交易于2025年5月15日暂停。 The Scheme was approved by unitholders at the scheme meeting and extraordinary general meeting in March 2025. Trading of Paragon REIT units was suspended on 15 May 2025.

担任Broadway工业集团强制性有条件现金要约的独立财务顾问 IFA to Broadway Industrial Group for Mandatory Conditional Cash Offer

制造业与精密工程 Manufacturing and Precision Engineering

2024年10月 October 2024

PPCF被任命为Broadway工业集团有限公司("BIGL")独立董事的独立财务顾问(IFA),涉及Patec Pte. Ltd.("Patec")提出的强制性有条件现金要约。 PPCF was appointed as the Independent Financial Adviser (IFA) to the independent directors of Broadway Industrial Group Limited ("BIGL") in relation to the mandatory conditional cash offer made by Patec Pte. Ltd. ("Patec").

Patec是在台湾上市的Patec精密工业股份有限公司的全资子公司,于2024年10月28日发起强制性有条件现金要约,以每股0.197新元的价格收购在新加坡交易所("SGX")上市的BIGL的所有已发行和缴足普通股。 Patec, a wholly-owned subsidiary of Taiwan-listed Patec Precision Industry Co., Ltd., launched a mandatory conditional cash offer to acquire all issued and paid-up ordinary shares of BIGL, a company listed on the Singapore Exchange ("SGX"), on 28 October 2024 at an offer price of S$0.197 per share.

在Patec获得有效接受后,要约于2024年11月14日成为无条件,加上其现有持股,超过了BIGL已发行股份的50%。到2024年12月20日,Patec的持股比例已增至91.9%,超过了根据新加坡《公司法》进行强制收购所需的90%门槛。 The offer became unconditional on 14 November 2024, after Patec secured valid acceptances that, together with its existing shareholdings, exceeded 50% of BIGL's total issued shares. By 20 December 2024, Patec's stake had increased to 91.9%, surpassing the 90% threshold required for compulsory acquisition under Singapore's Companies Act.

此后,持异议的股东根据《公司法》第215(3)条有权要求Patec以每股0.197新元的价格收购其股份,行使这一权利的截止日期为2025年4月10日。 Following this, dissenting shareholders were granted the right under Section 215(3) of the Companies Act to require Patec to acquire their shares at S$0.197 per share, with a deadline of 10 April 2025 to exercise this right.

Patec已宣布打算将BIGL从新加坡交易所退市,并将其业务与Patec集团整合,旨在提高效率和促进创新。 Patec has announced its intention to delist BIGL from the SGX and integrate its operations with the Patec Group, aiming to enhance efficiency and foster innovation.

担任Silverlake Axis有限公司自愿无条件要约的独立财务顾问 IFA to Silverlake Axis Ltd. for Voluntary Unconditional Offer

金融服务 Financial Services

2024年11月 November 2024

E2I Pte. Ltd.("E2I")发起自愿无条件要约,收购Silverlake Axis Ltd.("SAL")的所有已发行和缴足普通股。要约的对价由股东选择,要么(i)现金对价;要么(ii)E2I的现金和可赎回优先股。PPCF被任命为SAL独立董事的独立财务顾问(IFA)。 E2I Pte. Ltd. ("E2I") launched a voluntary unconditional offer to acquire all issued and paid-up ordinary shares of Silverlake Axis Ltd. ("SAL"). The consideration of the offer was at the election of shareholders of either (i) a cash consideration; or (ii) a cash and redeemable preference share in E2I. PPCF was appointed as the Independent Financial Adviser (IFA) to the independent directors of SAL.

担任NTUC健康合作社有限公司拟出售牙科业务的独立财务顾问 IFA to NTUC Health Co-Operative Ltd in relation to the Proposed Disposal of its Dental Business

医疗健康 Healthcare

2024年4月 April 2024

NTUC健康合作社有限公司("NTUC健康")收到了关联方Tangram Asia Capital LLP("Tangram Asia")的非约束性要约函,拟收购NTUC健康牙科业务的特定资产("Denticare业务")。Denticare业务(前身为Unity Denticare)为个人和家庭提供全面和综合的优质常规和预防性、修复性和美容牙科服务。 NTUC Health Co-Operative Ltd ("NTUC Health") had received a non-binding letter of offer from Tangram Asia Capital LLP ("Tangram Asia"), an interested person, for the acquisition of specified assets relating to the dental business of NTUC Health ("Denticare Business"). The Denticare Business (previously known as Unity Denticare) provides individual and families with a comprehensive and integrated suite of quality general and preventive, restorative and aesthetic dental services.

PPCF评估了拟出售Denticare业务是否按正常商业条款进行,且不损害NTUC健康的利益。我们的独立财务顾问函已提交给董事会。 PPCF assessed whether the proposed disposal of the Denticare Business was conducted on normal commercial terms and not prejudicial to the interests of NTUC Health. Our IFA letter was presented to the Board of Directors.

担任吉宝有限公司关联方交易的独立财务顾问 IFA to Keppel Ltd. for Interested Person Transactions

能源 Energy

2024年4月 April 2024

PPCF被吉宝有限公司任命为独立财务顾问(IFA),评估各项拟议关联方交易的条款,包括产能 tolling协议(CTA)和运营维护服务协议(OMSA)的修订、发行高达6.565亿新元的股份,以及获取高达3000万新元的信用证。 PPCF was appointed by Keppel Ltd. as the Independent Financial Adviser (IFA) to evaluate on the terms of various proposed interested person transactions, including amendments to the Capacity Tolling Agreement (CTA) and Operations and Maintenance Services Agreement (OMSA), issuance of up to S$656.5 million in shares, and procurement of letters of credit amounting to up to S$30 million.

PPCF评估了这些交易是否按正常商业条款进行,以表明这些关联方交易不损害股东和吉宝有限公司的利益。我们的独立财务顾问函已提交给董事会,并附在发送给股东的通函中。在2024年4月23日举行的特别股东大会上,股东批准了这些交易,为KMC的再融资和运营重组提供了便利。 PPCF assessed whether the transactions were conducted on normal commercial terms as so to opine that the IPTs were not prejudicial to the interests of shareholders and Keppel Ltd. Our IFA letter was presented to the Board of Directors and appended in the circular sent to shareholders. At the EGM held on 23 April 2024, shareholders approved the transactions, facilitating KMC's refinancing and operational restructuring.